In the last few years, there has been a significant increase in the number of payment options, all with a view to giving consumers more options while also improving security and convenience. One such method involves using a QR code—technology that is not exactly new but is being implemented in novel ways.

What is a QR Code Deposit?

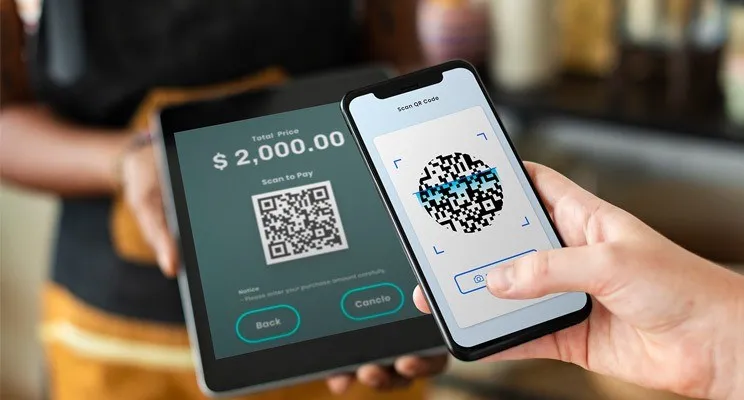

A QR code deposit is simply a payment made using a QR code. The business creates a QR code and ensures it is available to customers. The customer can then scan the code with their phone, enter the amount they wish to pay, and then process their payment.

It’s a payment method that’s already in use at merchants, but one that is also being picked up by sportsbooks, casinos, and other service providers. The idea is much the same across any business—as long as consumers can access and scan the code, they can spend/deposit money.

What are the Benefits of Using QR Code Deposits?

There are a few notable benefits of adding QR code deposit/payment options to your business. These apply regardless of the type of business that you run, and include:

They are more accessible

Everyone has a smartphone and every smartphone has a camera, so all consumers can use QR codes. It doesn’t matter where they are in the world or even what age they are—as long as they can point their phone at the code then they can make it work. It’s rare to find a payment method that is so accessible and convenient, and it’s rarer to find one that is easy even for technophobes to use.

It’s also possible to implement QR codes both online and offline, and creating the code is often as easy as clicking a few buttons.

They are incredibly easy to use for consumers

Point, wait, click, pay—that’s all there is to it. QR codes are easy for both the operator that makes this payment option available and the consumer that uses the code to make a payment.

They can be used for many businesses and products/services

QR codes can be used offline and online and for both services and products. Whether it’s an online casino giving players more options, a land-based sportsbook offering a simple way to process cashless payments, a supermarket chain, or an independent store, they can all use QR codes to process payments.

They should be available for all businesses and consumers

QR code payments are becoming increasingly common, with an uptake across the world and in many industries. They are also integrated into many platforms, from the Faster Payments Service in the United Kingdom to WeChat and Alipay in China. It’s a truly global payment option.

They are very safe and secure

As the data is encrypted and the transaction secure, QR code payments are very safe and offer a high degree of security. At a time when consumers are more aware of online safety issues and wary of using anything that could expose their personal or financial details, this is incredibly important.

Summary: A Game-Changer for Consumers and Operators

The QR code might not be as new as cryptocurrencies. In fact, it was first invented in the 1990s, so it was around for many years before Bitcoin and the blockchain were on everyone’s lips. But we’re still discovering new ways to use these codes, and QR code deposits are one of the most interesting. These codes could be a game-changer for businesses. After all, the main goal of every business is to make life easier for customers, and this deposit/payment method places a big green tick in that box.